September | 2020

In our first article, we cover the SAVE Framework’s S principle: Strategy. By implementing digital solutions that provide long-term impact for business, manufacturers can strategically maximize captive monetization while offsetting risk.

Most manufacturers have captive centers that provide enterprise IT solutions. These client-owned-and-operated service delivery centers serve as strategic solutions because they are typically located in nondomestic, low-cost locations and provide service resources directly to their organization. The associates within a captive facility are legal employees of the organization, not the vendor[1].

Manufacturing Industry and Captives:

As a Global IT Services sourcing strategy, captives were originally introduced 35 years ago and have been evolving since to create new enterprise IT solutions.

1985 Initiation |

1990-1998 Adoption |

1990 – 2006 Growth |

2006-2009 Diversification |

2009 - Present |

|---|---|---|---|---|

Texas Instruments establishes the first captive center in India, heralding the era of offshoring. |

British Airways and GE established and ramped up captives in India. The captive centers accounted for most of the process outsourcing work that came to India, with few Indian players till 1999. |

The global financial services sector rapidly adopts the captive model. Captives deliver $8 B worth of services in 2006. |

Due to financial crisis, Aviva sells its captive. New captives are added, and the growth continues. |

Today, captives are seen as business partners and more flexible global operating models have been developed. |

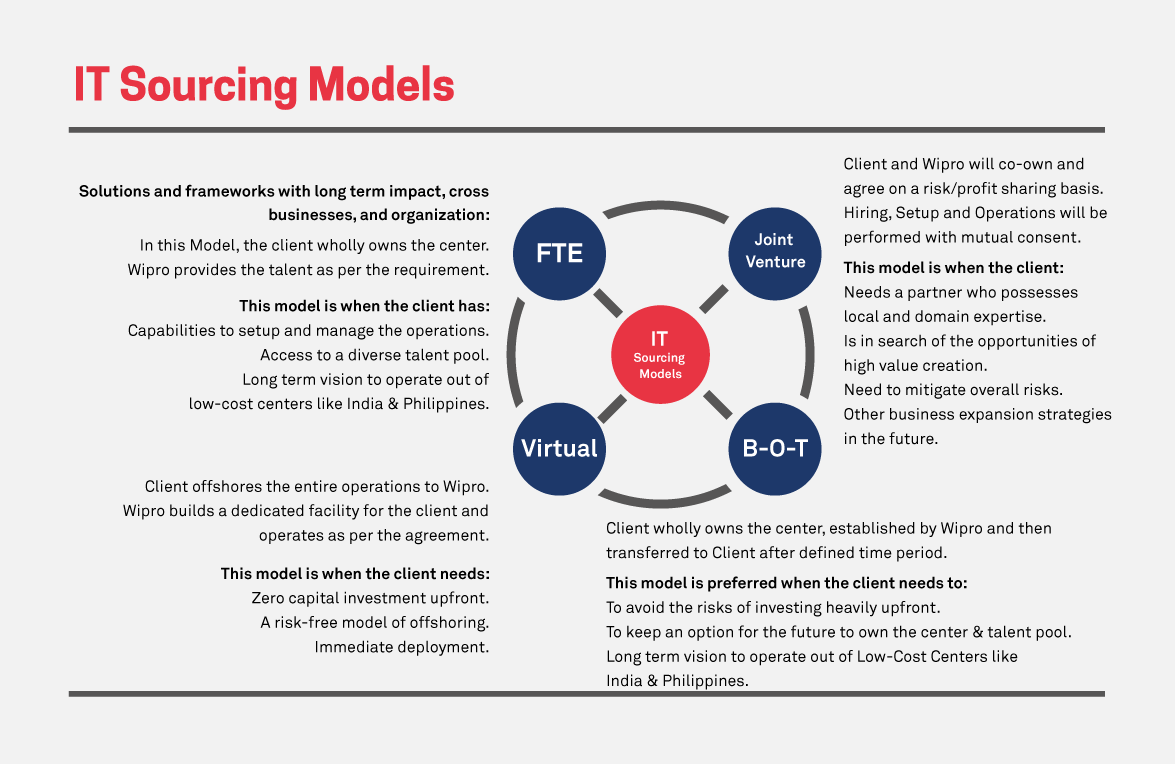

Typically, the IT Sourcing Strategies for manufacturers involve one of these models:

Year |

2009 |

2017 |

2019 |

|---|---|---|---|

Captive Centres in India |

900+ |

1,100+ |

1,400+ |

Employees |

390,000 |

800,000 |

1,000,000 |

Revenue |

$10.6 B |

$23 B |

$28.3 B |

Y-o-Y Growth of Revenue |

|

14.62% |

11.52% |

IT Captives (also known as Global Capability Centers (GCC)) are increasing consistently and account for more than $28 billion in revenue[3]. In 2019, more than 75 global companies including Manhattan Associates and Experian set up new centers or expanded their GICs (Global In-House Centers) in India as they tapped into local talent with skills in newer areas like Digital and Analytics for manufacturers to source enterprise IT solutions.

COVID-19, Working from Home, and the Future of Captives:

COVID-19 and its worldwide repercussions have severely impacted the manufacturing industry. For many employees, Work from Home (WFH) has become the norm. Suddenly, owning an offshore delivery center (ODC) and campus seems very inefficient for organizations, as CFOs face Cost Savings and Cost Optimization challenges and seek new strategies. Now, manufacturers need strategic solutions that still provide the enterprise IT solutions they need – captive monetization.

ISG[4] recently reported an increase in the number of backlogs that have developed at several captives, which creates delays in technology rollouts and other IT sourcing. Around 40% of all captives have less than 500 employees, and this current scenario is testing their resilience.

These captives face challenges like ensuring productivity while providing WFH capabilities and other capabilities for their employees – all while their parent companies are facing the challenge of reducing costs. Simultaneously, they continue to spend on fixed costs like rent as well as variable costs like electricity, hardware and software, and connectivity charges.

WFH setups have increased expenses overall due to employee needs like portable laptops and secure home connectivity. They have also incurred increased communications costs due to the majority of the employees needing cell phones.

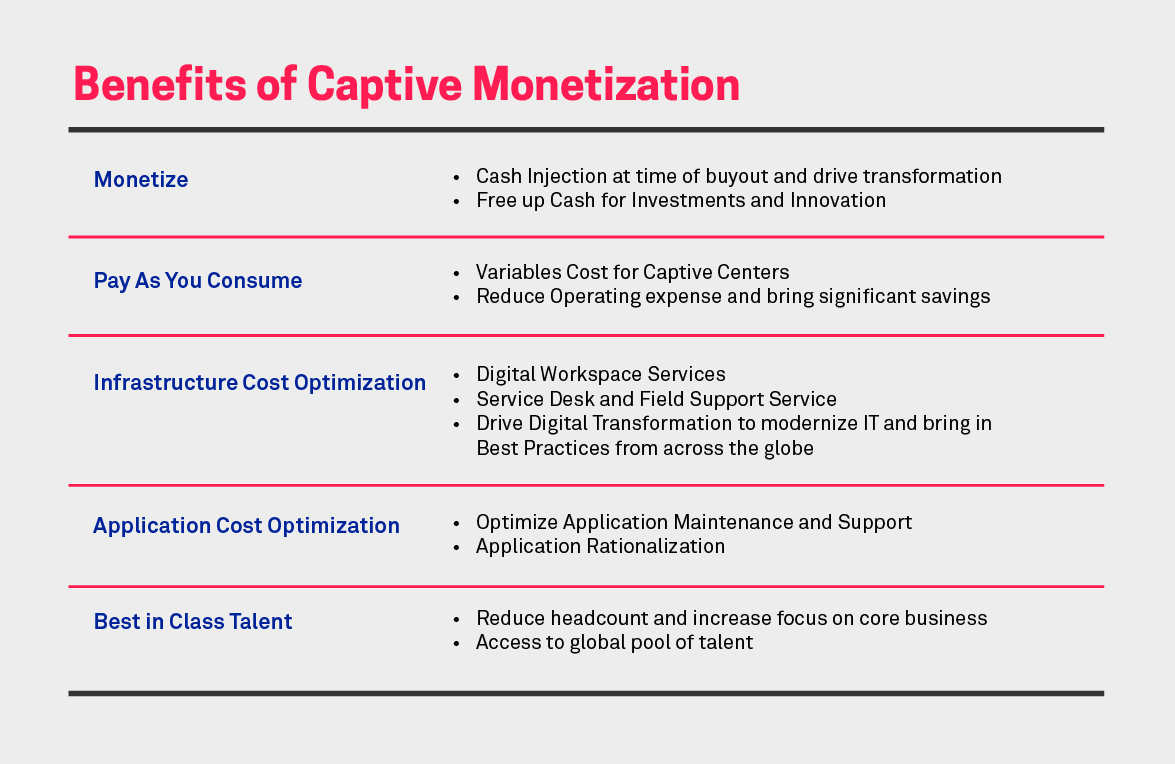

Having a captive at a time like this may not provide the strategic solutions it once did for manufacturers. These organizations can use a Captive Monetization strategy to ensure cost optimization. In this strategy, a System Integrator (SI) takes over captive operations and pays the client for the value of the captive’s assets (center, real estate, hardware, software, and employees). The client then contracts with the system integrator for the delivery for software projects.

An India-based System Integrator acquired Citibank’s captive for $505 million, and another U.S.-based System Integrator acquired UBS’s captive for $75 million. This captive monetization setup ensures that the parent company receives a timely infusion of cash while guaranteeing minimal disruption for day-to-day organization operations.

Looking forward, CFOs need to pursue captive monetization using strategic solutions. This will result in improved operations and cash infusion for digital transformation programs. The use of digital levers like artificial intelligence (AI) and robotic process automation (RPA) will optimize offshore employees on a continuous basis. Today, manufacturers have the opportunity to reevaluate IT sourcing strategies for the better.

The SAVE Framework Approach:

Wipro strategically partners with clients that own captives, carefully evaluating their worthiness of owning a captive right now and creative a captive monetization strategy. By divesting a captive, an organization can overcome the following challenges:

If you’re interested in learning more about the SAVE Framework and how you can optimize your manufacturing enterprise, check out the other three articles highlighting this special optimization approach. Or, if you have questions or would like to set up your obligation-free assessment, contact us today to begin.

References:

Namit Bhargava

GM & Head of Digital Sales, Digital Transformation

Passionate for results, Namit Bhargava brings innovative strategic perspective on Digital Transformation and Industry X.O themes for superior Customer Experience. Namit is a thought leader for CXO conversations for topics including digital strategy, transformation, new business models, and innovation.

Connect with Namit on LinkedIn

Savish Sadanandan

Senior Consultant, Digital Solutions

Savish Sadanandan is Senior Consultant focusing on bringing Digital Solutions across the Manufacturing Value Chain. Savish likes to analyze and understand the Client's pain points to identify linchpins which can drive Digital Transformation.

Connect with Savish on LinkedIn