A decade ago, the idea of ridesharing was born and the concept of access over ownership disrupted traditional business models. Why own a car when you can get access to it on demand? Why own CDs when you can access specific songs you like at the fraction of the cost? Welcome to the subscription economy, one that has given rise to Dollar Shave Club, iTunes, and Netflix - forever changing consumption patterns.

In an era where products get obsolete before they are launched, no one wants to buy just a product anymore. The key questions consumers are asking are - What more can you offer? How will you make product usage easier for me? Can I get upgrades cheaper, faster, and better? What can I expect in terms of service and maintenance? How can I pay for only what I use?

Moving from selling products to selling outcomes

Servitization is a manufacturer’s approach to offer customers a combined portfolio of smart products and associated services as a solution to their specific needs. It’s nothing new really. In fact, Rolls Royce pioneered the idea of products as a service when, in 1962, they offered power-by-the-hour for jet engine maintenance management. However, the concept is much more relevant now that it’s set to become the new paradigm of manufacturing operations in light of customer demands and the need to create competitive differentiation.

A servitization approach requires manufacturers to rethink their operations, financials, revenue models, and even their approach to sales and post-sale servicing. The days of single point transactions are over. No more can manufacturers wash their hands off after a product sale. Customers today demand much more proactive involvement and the manufactures’ ongoing commitment to ensure their products remain in working condition and deliver expected outcomes. The responsibility of product uptime is shifting from the end user to the manufacturer.

In fact, post-sale service and support have become so important that 63% manufacturers say service departments now play a strategic role in their business and 66% of them see it as a revenue generator. According to a McKinsey report, as compared to new product sales margins of~10 percent, aftermarket service margin averages 25 percent.

For instance, for a chemical manufacturer, selling chemicals when the customer is looking to buy them is no longer enough. They need is to invest instead in actively monitoring consumption at the customer site, replenish before the supply runs out, and only bill the customer for what they have consumed. This requires investment in smart tracking, monitoring, and data analytics systems as well as new approaches to invoicing, supply planning, and logistics.

Along the same lines, manufacturers across disciplines are looking at ways to servitize their products. Canoo, an electric vehicle startup, is looking to sell electric vehicles only on subscription models. Kone already has elevators that talk to its servers to optimize performance and maximize uptime. Philips is providing lighting-as-a-service to Amsterdam Airport Schiphol. Even in sectors such as paint and glass, servitization is taking hold with paint companies engaging customers through paint shops and virtual paint selection apps.

Sixty eight percent of manufacturers say servitization is already well on its way in their organizations – either well-established and paying dividends, or in-progress with leadership support.

Even with the push from customer demands and the need for manufacturers to find new revenue streams, servitization in manufacturing would not be possible without the right technology to support it. One of the key technology pillars is IoT that makes connected products possible. Servitization models are heavily dependent on the data from these connected systems. As more manufacturers move to the cloud, this data is available at high speed, in real time, on the edge to be analyzed and actioned – predictive maintenance, field service, product upgrades, re-order, usage recommendations, and cross-sell/ up-sell opportunities etc. Technologies such as AR/ VR, IoT and Big Data analytics, and Additive Manufacturing will enable easier data access for the manufacturer, helping them engage with customers directly, and provide consumption-based and value-added services.

For instance, the data from connected elevator can let Kone know when it’s time for product maintenance. This maintenance can then be scheduled at a time when the elevator is not in use – a fact determined by usage data previously sent by the elevator. This connectivity has the dual benefit of boosting customer experience – the maintenance does not interfere with usage – and lowering operational costs and efforts for Kone. In the case of Airport Schiphol, Philips was able to reduce the electricity consumption by 50 percent.

As technology gets more mature and AI gets into the mix to take data-based decisions, the impact of this technology convergence will only strengthen the servitization model.

While benefits of servitization are multifold, it’s not an easy transition to make. First, it needs a traditionally change-resistant industry to relook at its processes and second, it depends heavily on the digital maturity of the business. Every process – sales, finance, logistics, servicing – needs to be reimagined to fit in this new business model. For instance, your sales team will no longer be incentivized on a one-time sale, you have to figure out a new model based on the recurring revenue they bring in. Similarly, just a one-time PO based invoicing is no longer feasible, you have to monitor consumption, and bill for only what is used, making tracking and reporting accuracy vital for profitability. The integration of digital systems and technology is crucial to make this work. If your systems don’t talk to each other, then the model is doomed from the start.

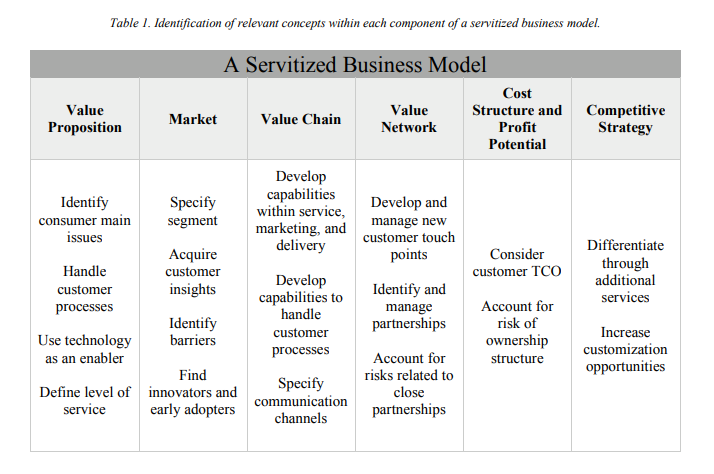

A manufacturing organization looking to take the servitization approach needs to:

Only when these pieces fall in place would a servitization approach work well for the manufacturer as well as their customers.

References

[i] https://www.rolls-royce.com/media/press-releases-archive/yr-2012/121030-the-hour.aspx

[ii] https://a.sfdcstatic.com/content/dam/www/ocms/assets/pdf/industries/2016-connected-services.pdf

[iii] https://industrytoday.com/article/impact-of-servitization-on-profitability/

[v] http://machineconversations.kone.com/

[vi] https://www.philips.com/a-w/about/news/archive/standard/news/press/2015/20150416-Philips-provides-Light-as-a-Service-to-Schiphol-Airport.html

[vii] https://www.ebnonline.com/author.asp?section_id=4082&doc_id=283175&page_number=2