January | 2020

This article discusses:

The competitive landscape for RPA, RPA vendors segmented on the basis of functions, market vs emerging players and future of RPA. Robots are slowly and steadily revolutionizing the way organizations operate by becoming more and more sophisticated and taking on higher value tasks, slowly replacing humans in repetitive tasks and even those tasks that require some level of decision making.

Increasing wage rates in offshoring sites like India and the increasing real estate and transport costs coupled with stiffening competition are significantly squeezing margins for service providers (Mindfields , 2017). The proliferation of large number of RPA players in the market alongside the increasing competition from new entrants and system aggregators is expected to drive down prices for service providers. This will be aggravated by the increase in cloud-based subscription offerings (Automation Anywhere, 2019).

Competitive landscape for RPA

The present competitive landscape has segmented itself into three key participants; service providers, technology vendors and technology integrators. The market would usually consist of service providers that are IT and technology firms providing end-to-end services for their clients. On the other hand, the technology vendors operate in the domain of software and typically provide software services to the clients. Technology Integrators combine subsystems into a whole to make sure they function together to deliver the required outcome (Nasscom, 2019).

The choice of RPA vendors by clients and industries are dependent on various parameters by which they judge the efficacy of the software. These parameters might entail the core specialization of the vendor or the market/domain expertise of the vendor. The vendor might also specialize in certain support function activities, such as tech support, technology and finance.

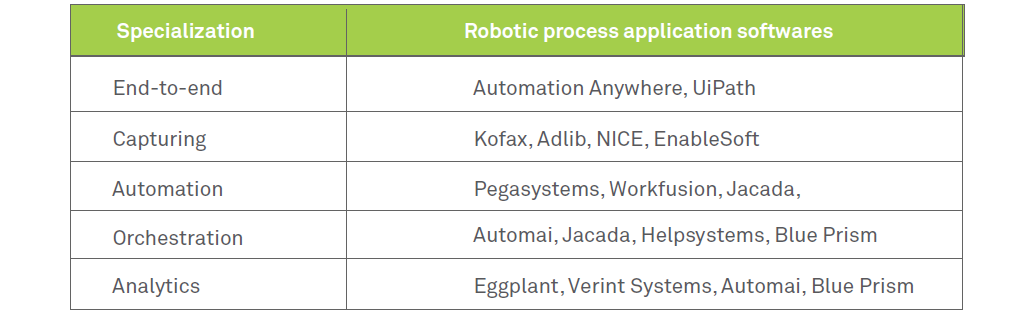

RPA vendors segmented into the functions they perform:

The RPA tools offer services that cover multiple activities/processes. Typically, RPA tools can be divided into segments depending on the types and functions they perform.

Vendors do offer end-to-end services to clients but usually one or more functions are poorly designed and the client might choose to utilize a specialized vendor for those specific processes:

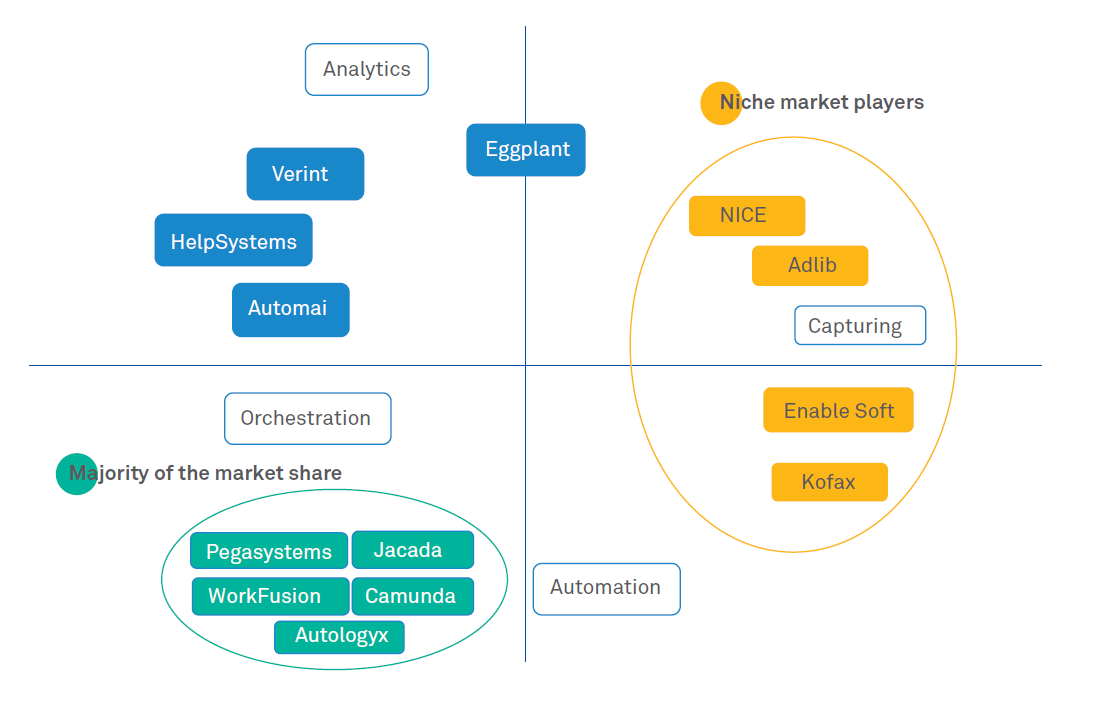

Market leaders vs. emerging players

The market leaders (UiPath and Automation Anywhere) have end-to-end capabilities, which include all four of the processes mentioned above. The products from these market leaders form a part of their complete RPA solution. Automation Anywhere provides the above processes in the form of Automation Anywhere Enterprise, IQ bot, Bot Insight, Bot Store. UiPath has similar products, namely UiPath platform, Studio, Robots and Orchestrator. Both the software providers have a detailed RPA training module but UiPath has a simple user interface and does not require coding knowledge like Automation Anywhere. UiPath tends to be a more intuitive software compared to Automation Anywhere, but lacks the capturing capability of Automation Anywhere.

Kofax has a strong capturing and prototyping module and subsequently specializes in data integration, capture while Pegasystems is a leader in software for customer engagement and operational excellence. Its core competencies are in Customer Relationship Management (CRM) software, Dynamic Case Management software. These two softwares would be a typical example of how two RPA vendors can form a strategic alliance to deliver an end-to-end solution to client.

The RPA market is bound to grow dramatically in 2019 owing to increased adoption not only by banking, financial services and insurance, but also other high growth sectors like health, telecom and information technology. This provides the RPA startups like Workfusion, Jacada, Automai the impetus look for brand new solutions in order to become the leaders in the race.

These startups specialize in certain RPA processes and usually tie up with the leading services provider/market leader to offer a one of a kind RPA solution. Autologyx has come to specialize in recruitment compliance alongside Tier-4 visa whereas Work fusion specializes in the domain of Fintech as well as capital markets data content. Jacada offers organizations to deliver effortless customer service through automation and orchestration that helps enabling automation and optimization of processes. Eggplant specializes in providing user centric, digital automation intelligence that enhance the quality and performance of the digital experience. Eggplant remains one the few players that have specialized in actionable intelligence when it concerns Robotic Process Application.

Figure 1: RPA vendors classification based on their competitive advantage of their work functions

Figure 2: RPA vendors and their core specializations

The future of RPA

The total revenue share commanded by RPA vendors that fall in the quadrant of orchestration-automation is close to 39.6% of the total market share. This might reflect the fact that the focus of automation for clients is automation of core processes and process improvement. Capturing and prototyping have niche players that have specialized in the process and usually end up being paired with automation-orchestration RPA vendors to provide end-to-end solutions to clients. The increased RPA adoption will lead to saturation within the orchestration-automation sphere while niche players will be preferred for capturing. Will analytics-orchestration become an extremely important quadrant for clients to choose an RPA software in the future due to its ability to provide actionable intelligence in real time thereby drastically improving business processes?

The automation priorities for enterprises is generally based on their operational and strategic priorities. These priorities are set by weighing the trade-off between estimate costs and the expected benefits. The top three priorities for operations within organizations are:

The levels of automation differ within industries where Technology-Media-Communications as well as Finance are leading the pack with 29% advancement and are predicted to reach a 50+% advancement level in the two years. The energyutilities industry is bound to pick up and reach 32% advancement in the next two years from a 9% at present.

The preferred RPA software would obviously be dependent on the specialization that the software has achieved in the past years as well the kind of clients and processes the software was associated with. The Insurance industry typically has high degree of standardization in the areas of workers compensation, auto and property and therefore would apply vendors that have achieved a certain level of competence in either the domain or the process associated with it. Specifically for the Energy and Utilities industry the center point for growth would be to help companies manage the transactions efficiently, while simultaneously enhancing the customer experience typically employed within the payroll, human resource and IT backup operations (Protiviti, 2019).

RPA is bound to grow and enterprises are slowly growing aware of its benefits. This will only be amplified by the integration with other tools and technologies that will subsequently result in efficient processes. A combination of machine learning, big data, AI and cloud will be used to create new models and to further refine them.

References

Kunjal Kaw

Digital Operations & Platforms, Enterprise Operations Transformation, Wipro

Kunjal has five years of experience across advertising, media & PR covering brand management, strategic marketing, ATL/BTL/digital ddvertising and trade marketing. He has hands-on experience in Trade Marketing and Brand Strategy across various brands.