The oil and gas industry has driven significant digital disruption and reinvention in recent years. The industry had no choice. Catalysts for this change have included the race to decarbonize, the evolution of the value chain to enable lower-carbon energy products, the need to drive deeper efficiency in assets and operations, the need for talent to manage distributed capital assets, and more. Companies have shifted significant momentum into cloud adoption, portfolio rationalization, cloud-native solutions, and edge technologies. They have even pursued disruptive hardware technologies: new age marine vibrators that prevent potential disruptions to the natural patterns of marine life during seismic imaging, advanced remote-operated underwater vehicles, and nanoparticles in drilling fluids and well cementing.

As energy businesses shift to the promise of artificial intelligence, many have laid significant groundwork for AI – through data governance, confidence, stewardship, and ingestion into data platforms, and also through business representatives taking on product owner roles, as they shape the future of solutions and portfolios. Mindsets have shifted to embrace new ways of working and there is an intense focus on data-driven and autonomous operations.

Companies are increasingly focused on developing robust and reliable AI muscle to help them make better decisions, face fewer equipment or operations failures, move products efficiently along greener paths, bring enhanced experiences to B2C and B2B customers, and attract early-career talent. With the arrival of GenAI, the interest in AI has increased exponentially. The good news is that the universe of possible Generative AI use cases in the energy sector is significant. The challenge is that the GenAI innovation curve will be faster than any previous technology innovation, and an enterprise that falters is at risk of being left behind. An organized approach can enable an accelerated and well-defined AI strategy.

The Impact of GenAI

AI will impact the entire industry, from exploratory upstream use cases to customer-facing scenarios in energy retail. AI will unlock efficiencies that pave the way to new, less carbon-intensive business models, and GenAI will play a growing role in the sector’s AI programs. GenAI can analyze large volumes of data from sources such as seismic surveys, well logs, and production logs to identify patterns, anomalies, and correlations. GenAI models can play a role in improving production, modeling reservoirs, and spurring higher-quality decision-making. GenAI will play a critical role in the asset lifecycle, analyzing sensor data and historical maintenance records to predict equipment failures and recommend proactive maintenance actions to boost operational efficiency, reduce downtime, enable a lower carbon intensity, and improve safety. GenAI could also generate personalized promotional content while a customer is at a retail forecourt.

This impact is not just theoretical. One energy company, to pick an example, recently leveraged GenAI to re-envision procurement, achieving capabilities such as intelligent GenAI-enabled supplier recommendations, 360-degree views of supplier bids, and a digital scope-of-work builder.

Vetting GenAI Feasibility

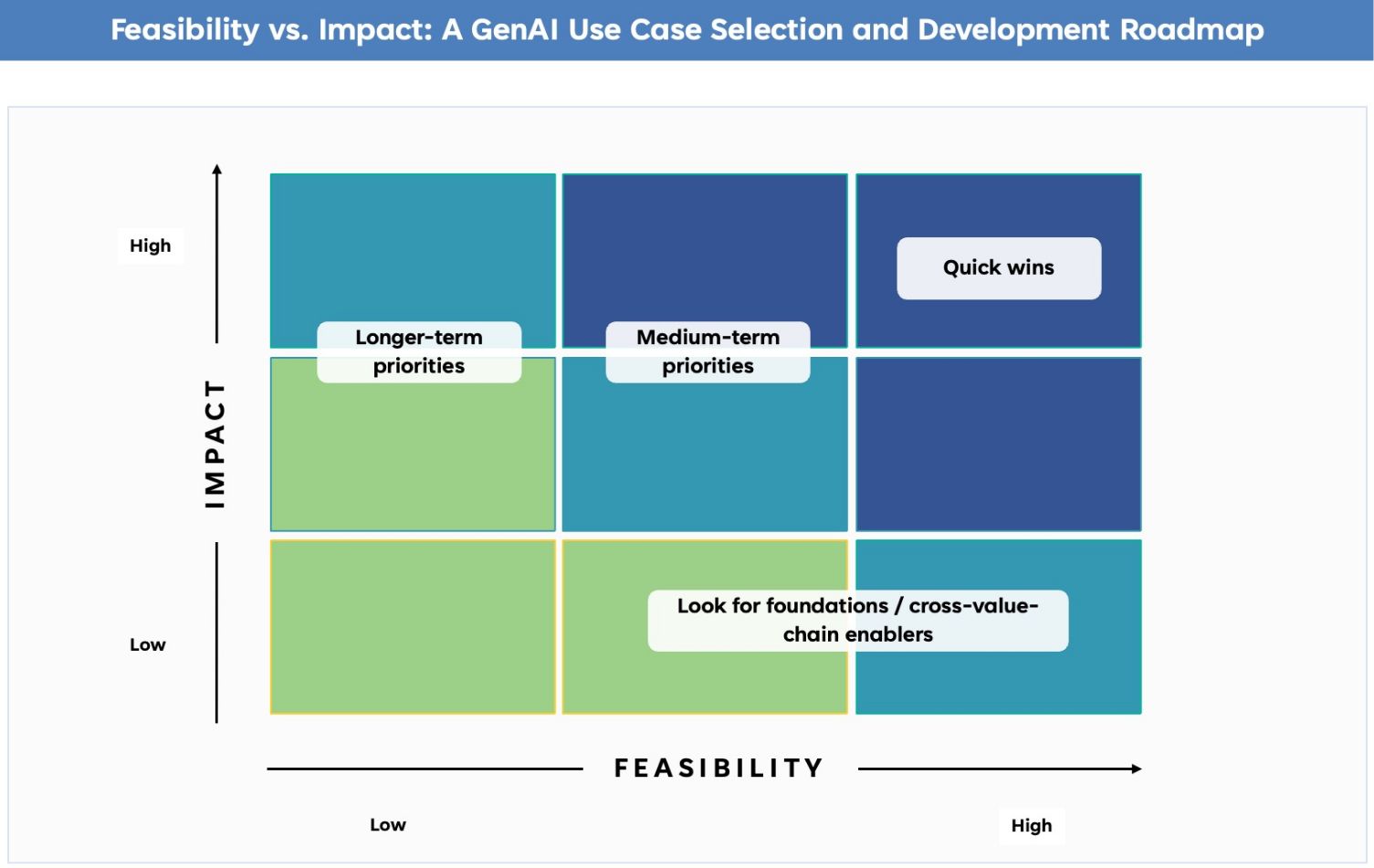

AI investment decisions must balance potential impact with an informed sense of real-world feasibility. For oil and gas companies, this means that there is no single list of ideal use cases that are fit for an GenAI solution. Instead, the most advantageous use cases will be intimately tied to the company’s strategic intent and their preexisting data ecosystem.

While the potential impact of GenAI on the energy industry is undeniable, energy enterprises also need to consider feasibility across the following dimensions:

- Technical maturity and feasibility: Is GenAI mature enough for this use case? Is a large language model (LLM) approach relevant? Do we require a deterministic or stochastic result?

- Data feasibility: Are the data sources of high integrity? Is the data correctible? Are the data sources and corrections highly trusted?

- User acceptance feasibility: Is the role of the user service-focused or techno-functional? Does the user community readily embrace digital solutions? Is the user community averse to business risk, or can they be compelled to trust an AI solution over time?

- Risk of adoption: Given the risks in day-to-day operations (to life, health, safety, and the environment), what risk is added by false or hallucinated GenAI results? This question can underpin a reticence to move forward with an AI strategy. That said, given the massive growth of data volumes and data types in today’s energy businesses, an alternate question is: What risks are we incurring by not using GenAI to rapidly reveal hazards, to identify pending failures, to recognize problematic trends, or to solve problems that are not easily handled by traditional surveillance and monitoring capabilities? Both angles should be considered.