This article is the second in a two-part series, ‘Mergers and Acquisitions: Accelerating business value realization using the Agile approach’, in which we outline the challenges inherent to acquisitions and present the solutions offered by the Agile approach. To see part one of this series, please click here.

In the first article in this series, we looked at the challenges of the acquisition process and discussed how keeping an eye on the end state, partnering with a third party, and taking the Agile approach can improve outcomes and allow companies to realize benefits faster. In this article, we will present specific recommendations for implementing the Agile approach.

Level-set with the board

At the start of the acquisition journey, consider setting the acquiring board down in a room to discuss key aspects of the acquisition. You may be surprised by the level of disagreement on the rationale or value of the proposed acquisition between members of the leadership team, and if they can’t come to an agreement, then success is going to be difficult to achieve.

The structure of such a meeting will vary depending on the target, the current business environment, and other factors, but it should aim to assess the level of agreement and find a way to bridge significant gaps. Evaluate the consensus in the room on these four questions:

Figure 1: Typical activities performed in each phase of an acquisition program

Using the third question to determine how the business will operate can help set business priorities, for either the long or short term. For example, if you acquire a business unit rather than an entire business, you will need to operate on Day 1 at arm’s length, as you will not be able to integrate immediately. The selling company will normally operate the systems and processes of the divested entity under a transition services agreement (TSA), though the plan may vary depending on the willingness of all parties. Once you establish your Day 1 operating model, as well as the operating intent for the acquisition post-TSA, you can focus your due diligence and Day 1 planning activities on the most impacted areas. By setting lesser considerations to the side, you can streamline the program and ensure the presence of sufficient resources with skills in the focus areas.

Identifying priorities

The intent of this exercise is to identify a prioritized list of business areas that will be integrated in order to derive maximum value for the acquiring business. If, for example, the business has identified merging the raw material procurement processes as significantly valuable due to the contracts held by either or both businesses, then procurement could well be a candidate for early integration. In this case, your focus would be on the following activities:

Figure 2: Focused Target Operating Model (TOM) Impact Analysis

Figure 3: Business decisions drive TOM planning

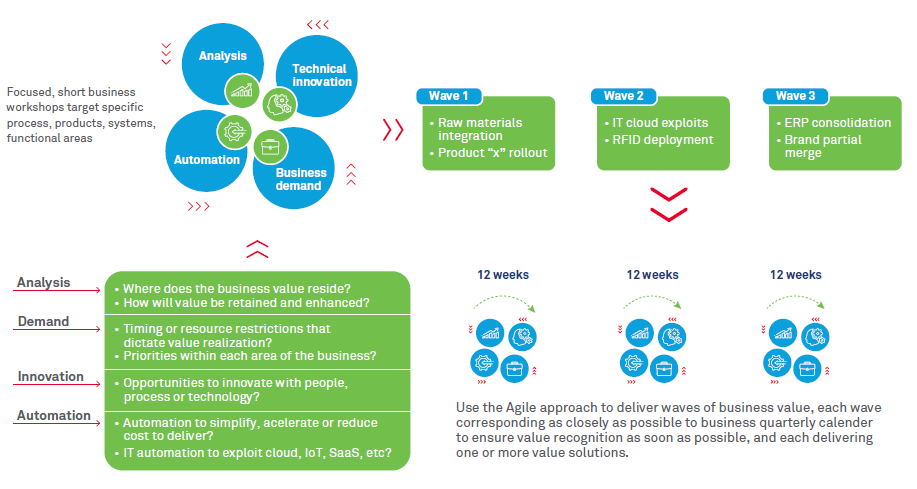

Finally, while you are being more agile, don’t discount opportunities to improve productivity by simplifying processes, removing handoffs, rationalizing applications, and implementing cloud computing and robotic automation. While doing anything over and above the work required to exit a TSA agreement can increase risks to exit, and therefore potentially add cost, companies rarely revisit acquisition opportunities once the merger has been completed.

Conclusions

The delivery of a successful post-acquisition integration is never going to be without its challenges, and the options highlighted in this paper won’t eliminate all of the risks. However, the Agile approach to all key phases in an acquisition will mitigate risks to a more acceptable level and allow an acquiring business to realize the value of its purchase much faster than traditional approaches allow.

Businesses often lose time and money focusing team efforts on attributes of an acquisition that are not immediately relevant and miss potential opportunities to speed up the process or innovate around the end vision. Using the Agile approach and partnering with an experienced integration team that can recognize the value in both businesses can have a huge positive impact on the success of your acquisition.

Carl Booth

Consulting Partner, Strategy & Transformation Consulting

Consulting Practice, Wipro Limited

Carl Booth leads key client initiatives in business transformation, target operating models, mergers and acquisitions, program management, and enterprise architecture across multiple verticals. He has advised senior executives of leading companies to improve business performance through transformation and business restructuring and has led a number of strategic mergers-and-acquisitions initiatives. Get in touch: global.consulting@wipro.com