With industry testing of T+1 settlement scheduled to begin in the US and Canada in Q3 of 2023, market participants have less than a year to prepare for the new trading cycle. On the surface, optimism reigns. Five years ago, the reasoning goes, the challenges of the T+3 to T+2 transition were overhyped. Surely, the transition to T+1 will be similarly seamless.

What many market participants are starting to realize, as they drill down into the operational details of T+1, is that the shift to T+1 will place fundamentally new strains on their operations. While the overarching industry frameworks for T+1 are falling into place, neither the dealers and asset managers nor the buy-side firms nor the custodial banks know how, exactly, they will achieve a seamless transition to T+1 on an operational level.

Overall, T+1 will clearly be a good thing for the industry, significantly reducing margin requirements and lowering market risk. However, not all market participants will benefit equally, and the companies that are truly unprepared will experience serious impacts to their operational efficiency and their bottom line.

T+1 Complications

Moving from T+2 to T+1 means that all processes and technology support for settling equities, corporate bonds, UITs, ETFs, ADRs, security-based swaps and options must be transformed to accomplish all relevant tasks on trade date. All told, more than 80% of the activity that now happens on T+1 will need to happen on T+0. Depository cutoffs for submitting trades for settlement will occur at approximately 10:45pm US ET on trade date, and all files will need to be submitted to DTCC by that time.

If firms do not fundamentally rethink their trading processes, employees in their New York-based operations will need to work from 8am to 10:45pm ET to accommodate the new timeline. Firm operations will not be able to support potential 14-hour days, day in and day out, without breaking down. Some firms are considering relocating their back-office operations westward, but that will mostly move both the beginning and the end of the day earlier, and not solve the overall workload issue.

The move to T+1 will significantly impact even simple and ubiquitous processes like allocations. Instead of breaking batched trades into allocations on T+1, which is the current practice, custodian banks will now have to complete all allocations late on the trade date itself.

The more complicated the trades in question, the harder they will be to accommodate in a T+1 world. The process of recalling a security out on loan, for example, will be accelerated, and T+1 may impact the profitability of securities lending across the board if it becomes more expensive to pull off. Cross-border trades of US securities, which require a separate foreign exchange settlement in addition to the securities settlement, present another puzzle. Digital currency is being proposed as a method for settling both trades on the same day, but such a solution is completely untested and unlikely to be in place by late 2023. And when it comes to back-to-back trades, current technology struggles to perform well in a T+2 world, much less a T+1 world.

Assessing T+1 Preparedness

Firms without a clear and comprehensive T+1 roadmap should not lull themselves into thinking that, over the next year, solutions will simply emerge of their own accord—particularly if they plan on developing T+1 capacities largely in-house.

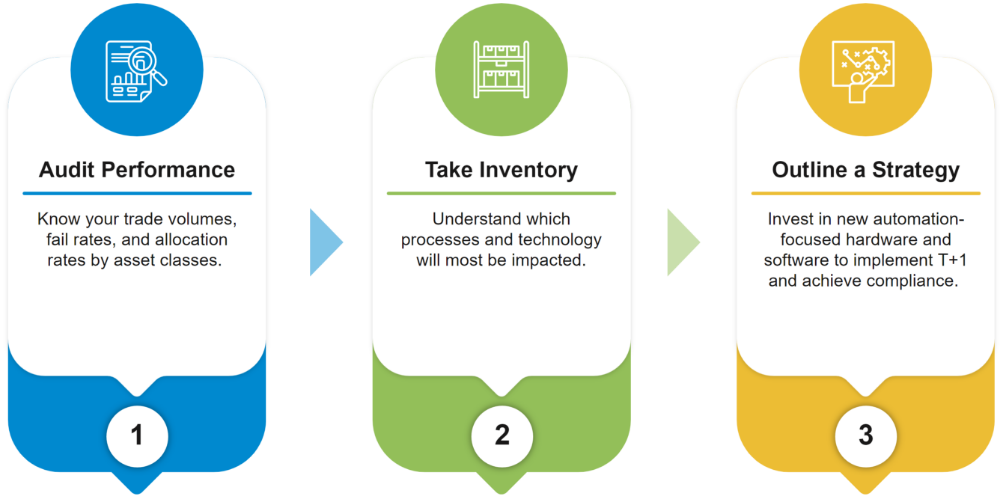

Firms need to aggressively rethink their trading and post-trade systems to handle these complexities at volume. To address the operational challenges of T+1, they will need to:

1. Audit current performance. Firms first need to know their current trade volumes, trade fail rates, allocations rates and affirmation/confirmation rates—and they need to capture these datapoints for each individual asset class. Late settlements and trade failures can only get worse under T+1, and a comprehensive audit of current performance will reveal the weakest links in the system.

2. Inventory vendor support systems, trading systems and hardware/software. Market participants need to understand which technology and operational systems will be most impacted by T+1. While the DTCC’s industry implementation playbook is a good starting point, many market participants will require rapid support from technology partners to assist in vetting the current technologies in light of future requirements.

3. Outline a technology-driven strategy. After determining what changes will be required to implement T+1 settlement, firms need to aggressively invest in new hardware and software to power their trading systems—and ensure that their third-party vendors and service bureau support companies are also prepared to achieve compliance. Ideally, these new technology solutions should lean toward automation rather than outsourcing.

Automation: T+1 Readiness Through Technology

Certainly, some firms will look to outsourcing, spreading the trading day workload across multiple geographies. While this strategy may allow firms to accommodate to a T+1 trading schedule without a drastic spike in late settlements and failed trades, it will be very expensive to solve all T+1 challenges simply by throwing people at the problem.

Rather than relying on the same systems while utilizing more people in more geographies, market participants should use T+1 as an occasion to significantly upgrade their technology capabilities. Most firms understand that their current practices are rife with inefficiencies. They can get away with inefficiencies because the T+2 settlement cycle allows numerous confusions, mistakes and exceptions to be ironed out manually on the second day of the trade cycle. Adopting automation will not only enable T+1 compliance but will also increase operational efficiency and resilience.

Most firms today operate with multiple processing systems tied to the individual product categories being traded, and those systems often rely on batch processing. Batch processing will not work for T+1 settlement. Systems will need to be processing continuously, in as close to real time as possible. Opportunities to manually repair trades, fix mistakes and resolve exceptions during the trade settlement cycle simply will not exist. An automation strategy must holistically address technology systems and data across all product categories, including reference data, standing instructions, corporate actions, securities lending, repo, collateral and liquidity management, trade funding and payments. Firms must adopt a bias toward retiring legacy systems, particularly batch systems, and truly transform the middle and back office into an integrated, automation-driven processing system.

Michael Barrett

Senior Partner & US Regional Head of Securities and Capital Markets Domain & Consulting

Michael is an accomplished capital markets and wholesale banking domain expert with more than three decades of experience in global markets, prime services, global securities services and fund administration, derivatives, global securities finance, margin and collateral management, and has successfully led front, middle and back-office lines of business for major financial institutions and market infrastructure. Before joining Wipro, Michael was Vice President of Business Technology Services at Genpact Headstrong Capital Markets in a global role, one of many business and service lines he led during his 8 years at the firm. Prior to joining Genpact Headstrong, Michael was a founding partner in GCMS LLC, a strategic advisory firm which advised banks and securities firms on how to meet the challenges stemming from regulatory reforms such as Dodd Frank and EMIR, focusing on liquidity, capital, margin, exposure, collateral management and valuations.