February | 2022

Imagine having an idea to start an internet company and then following up with it by working hard on improving your revenues, profits, and your brand image. Day-in, day-out you hustle despite facing so many challenges in this uncertain world. And then one day after 10 years of hard work, you become a well-established brand in your industry. On the day you hit the official milestone of 10 years, you notice that some customers made a large amount of high value purchases which is great, considering the occasion.

Then, one day your company gets an e-mail from several angry customers about how someone hacked their accounts and used their payment details to make some very large purchases. The purchases coincide with the ones made on your 10th year anniversary celebration. The customers are angry with your company and they post scathing messages about your company on leading social media platforms. Some of them filed lawsuits against you. Your investors and board members send threatening e-mails demanding justification and a quick solution.

As you sit among several negative mails and court orders, you realize that your company is hanging by a thread and all the work that you had put over the last 10 years have gone down the metaphorical drain.

This story might be fictional, but the underlying problem mentioned is an unfortunate reality.

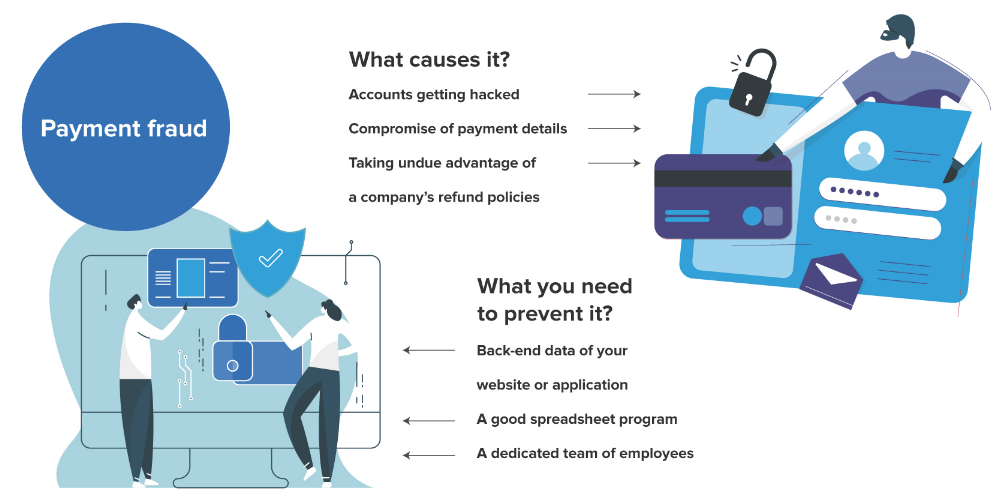

We define payment fraud as any action taken by certain people or a group of people or by computer programs, during digital business transactions of a company or a group of companies, which cause significant tangible and intangible losses to both the victim and the company.

Three of the most common methods of payment fraud include:

In 2018, companies incurred losses worth over $24 billion due to payment fraud and is estimated to have increased by 18.4% percent every year till date.

In this article, we talk about how a good proactive payment fraud management program can help you mitigate fraud.

This article will be useful to you if you are an owner or manager of a company that regularly deals with digital transactions (such as e-commerce) or plans to use digital methods of payments in the future.

The methodology we have created lists out how you can prevent fraud in your transactions, and all it requires is the following-

Bringing your back-end data to the forefront

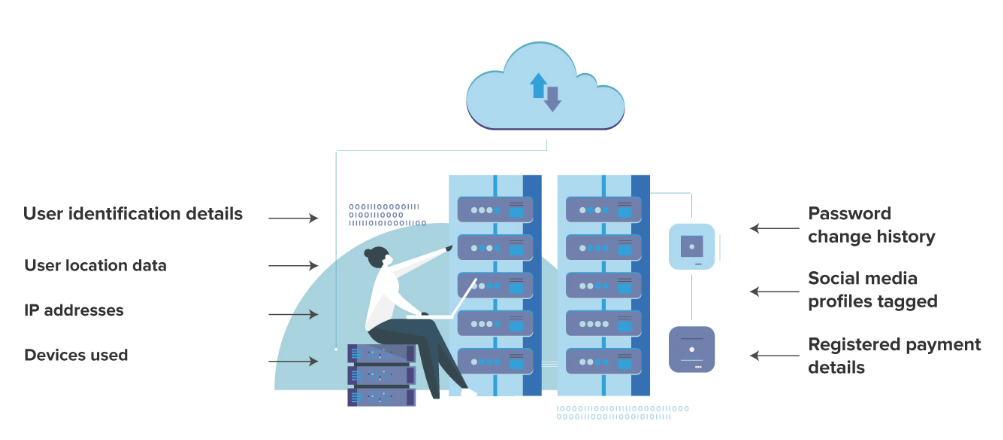

For any website or mobile application, there is a plethora of data being generated every second based on the activity of your users. If your business is based on a website-driven model or mobile application-driven model, then you also have a resource called the webmaster; some of you might have an entire team of individuals who take care of your website/application.

This individual/team is exposed to vast amounts of key back-end data on a regular basis, and you could use this data to detect any patterns of fraudulent behavior. There are various types of data generated by the servers of your website/application; however the following are significant for prevention of payment fraud:

It must be noted that all the above data types obtained from the backend needs to be analyzed together to come to a plausible conclusion of fraudulent activity. Analyzing them in isolation may not give you the complete picture.

The next steps

In this article, we talked about the basics of payment fraud and its implications. In the next article, we will talk about a simple payment fraud management methodology that you can employ in your company with very little cost.

Part 2 introduces a simple and effective methodology of payment fraud management and can be accessed here.

Part 3 highlights all the investments required for companies to set up a robust payment fraud management system and can be accessed here.

D. Davis Pinto

Davis is a senior manager (payment risk operations) in the digital operations and platforms (BPS) service line of Wipro. He has over 17 years of experience in the field of payment risk management and currently manages a team with over 1,000 employees that prevents payment fraud on a daily basis. He is an improvement-oriented person with a vast amount of experience in the trust and safety industry and works very hard to meet and exceed the demands of our customers.

B. Leepika

Leepika is a senior group leader (payment risk operations) in the digital operations and platforms (BPS) service line of Wipro. She has over 7 years of experience in evaluating transactions for potential fraud, and currently heads a team of more than 150 employees in BPS’s payment fraud management division. She believes in putting herself in the customer’s shoes and keeping up to date with the latest payment fraud trends.

Richards TV

Richards is a marketing executive and a content writer in the consumer business vertical of Wipro-BPS. He is an engineer-turned marketing professional with an avid interest in all things marketing, trust & safety, and the latest technology trends.