Client background

Client: Leading global denim company

Industry: Manufacturing and Retail

Products or services: Jeans and Apparels

Areas of operations: North America (including Mexico and Canada), Europe, Asia, Middle East, and Africa

Annual revenue: $4.5B

Challenges

The client faced multiple challenges that affected process efficiency in the following ways:

- Revenue Forecast:

- The current quarterly revenue forecasts were not consistent, and accuracy varied around 80%.

- Revenues were based on manual data extraction and consolidation, which consumed over 50% of time.

- Inaccurate predictions led to an increase in cost on the production line.

- Order to cash:

- Non-standardized Accounts Receivable (AR) under Finance and Order Management (OM) in customer service resulted in siloed environments, driving customer dissatisfaction and high volumes of unapplied cash, which led to credit hold.

- Sales Order Inventory research and sorting of mismatched prices consumed more than two hours per day, per FTE.

- The average Turn Around Time (TAT) for order was 4 to 5 hours.

- Record to Report:

- No mechanism to track the status of month-end activities and perform root cause analysis for improvement.

- Overstretched month-end close timelines.

- Procure to Pay:

- As the name suggests, duplicate payments means that the systems or team have a high probability of making duplicate payments.

- Unpaid PO - There was no timely reporting to display unpaid PO, leading to complexity in revenue prediction owing to multiple variable factors, including past and probable future events.

Solution

Wipro took on the challenges by implementing process improvements and automation tools.

- Revenue Prediction:

- Wipro Digital Advanced AI practice provided AutoML based AI-powered revenue shaping solutions to the client. These solutions were grounded in state of the art technologies and combined the optimization capability of deep learning, algorithms for reasoning, methods for deriving causal relationships, and Bayesian inferences for estimating uncertainty. We implemented a real-time dashboard for data inference to enhance quick decision making.

- Order to Cash:

- Order management and AR were brought under a unified management and provided with end- to-end accountability for streamlining the user experience. Wipro also deployed descriptive analytics using Tableau and predictive analytics through the R and SQL servers. Bots enhanced process efficiency. The client’s customers who were on EDI orders were supported through customer portals that enhanced user experiences.

- Implementation of error proofing, error tracking, and validation bots to streamline processes in sales order management.

- Record to Report:

- Leveraged Blackline and Base))) reports for book close monitoring and analysis, as well as error analysis and to identify preventive actions.

- Real-time access was provided to MIS through Wipro Base)))TM Prism and Wipro Base)))TM Govern for quick insights and actions.

- Procure to Pay:

- Deployment of an AI-based anomaly detection tool to identify and resolve duplicate and fraudulent payments.

- Cockpit access to download due PO reports for automated identification of cases.

Business Impact

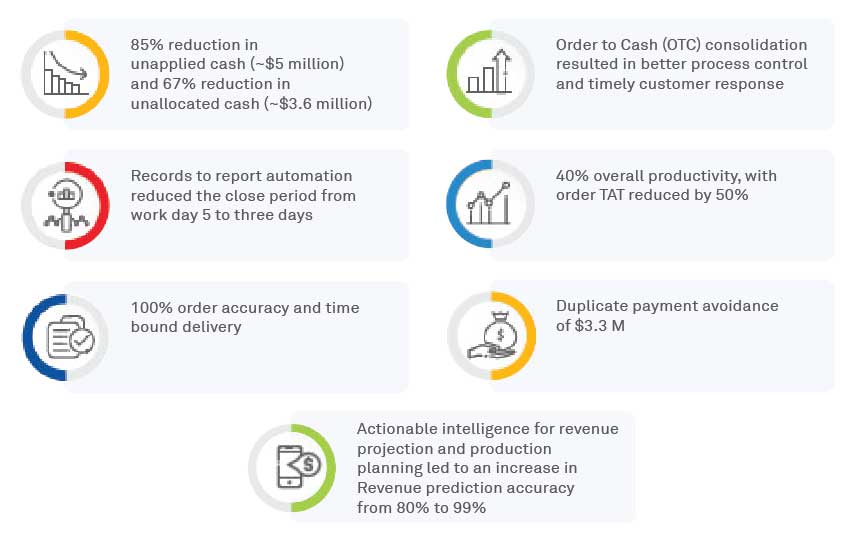

The deployed solutions helped in cost saving and improved process efficiency. They positively impacted business in the following ways: