Artificial Intelligence (AI) promises to bring in a new era in digital transformation that will disrupt process execution and drive next level of productivity and efficiency improvements.

In this article, we will discuss two key finance processes that will have a large impact from an AI perspective.

AI impact on Procure to Pay and Order to Cash processes

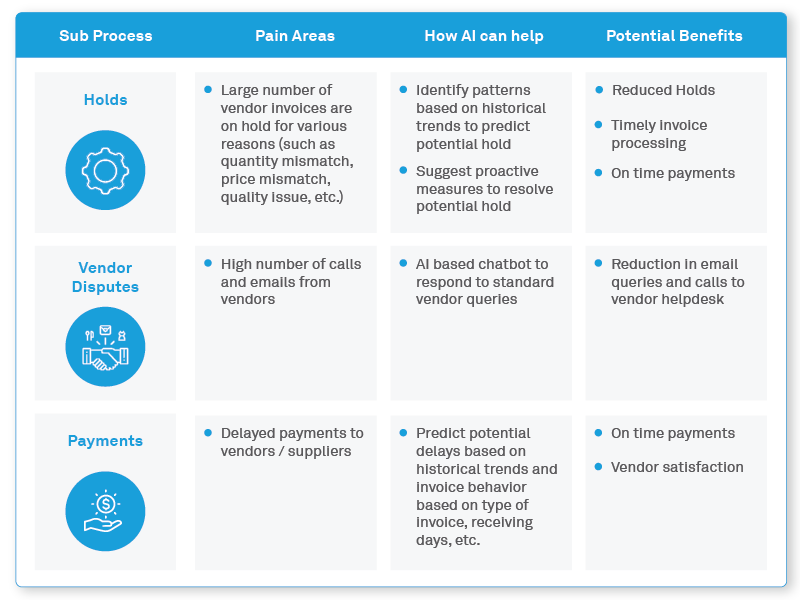

1. Procure to Pay

Procure to Pay processes deal with vendor master, purchase order, invoice receipt, scanning & mailroom (for physical invoices), invoice entry, PO 2/3 way matching, invoice processing, holds, disputes management and payment processing. While there are many products in the market that enable e-invoicing to resolve some problems, there are only a few products in the AI space.

Table 1 shows a few examples of how AI can help bring the next level of transformation in the Procure to Pay processes