When a customer uploads an outdated version of forms or ones with missing signatures, the agents experience an interrupted workflow because they have to re-evaluate these forms for the accuracy of the seeded information. Such paperwork errors can affect productivity and company ROI. Why? Because claims or applications featuring Not In Good Order (NIGO) documents halt form processing and place a premium on agents to manually chase their applicants to fix these errors, leading to inevitable business costs.

Policy servicing and catering to various change requests often involve processing multiple manual forms, letters, and other correspondence in traditional insurers. As per available data, 40% of these documents include errors leading to NIGO forms that disrupt workflows, causing SLA breach, TAT non-adherence, and other compliance issues. Insurance carriers have no choice but to seek more information from the customer to address NIGO issues, increasing the cost of per-policy servicing.

The main scenarios for NIGO errors are:

A significant number of customers of traditional carriers are not aware of the process of policy service requests. As a result, customers prefer to talk to their agents/field representatives and get their requests processed directly. This forces agents/field representatives to spend a significant amount of time addressing customer issues and initiating such requests. Often they turn to the customer representative (contact center) to address complex requests on behalf of their customers.

Customers often do not receive adequate help or are unaware of the assist features required to ensure that the forms are error-free. They seek extensive support from customer representatives on even simple requests leading to repeat queries, error-prone requests, and a negative customer journey. Social media is full of such examples of customers venting their displeasure at the complexity of processes and lack of information.

Explaining the problem

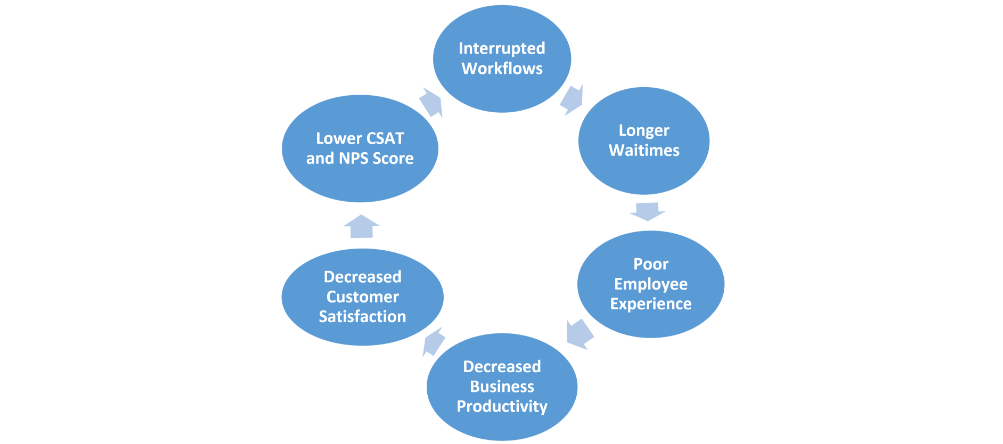

While creating a significant impact on the field and customer representatives, both the above scenarios also generate negative customer experiences due to the complexity of the process. It makes potential new customers think of perceptional inefficiencies, which affect the entire insurance value chain.

The current proliferation of many small to medium-sized form systems indicates that life insurance carriers have failed to integrate and have not realized the benefits of end-to-end transformation levers. These repetitive, transactional activities also affect operational scalability and the ability to respond to seasonal spikes in policyholder requests in an agile manner.

Decoding the solution

Insurers need to realize that NIGO issues are part of a bigger problem that a limited reactive approach will not sort. They need to look at building a mature capability that has:

Since NIGO is one of the prime reasons for the high cost of policy servicing, insurance carriers should not settle for NIGO document processing as an unavoidable operating cost. They need to look at it as an opportunity for operating cost reduction, customer satisfaction, customer retention, and employee productivity.

Insurance carriers must partner with players who have the right capabilities and understanding to balance real-time assistance and automation needs. The partner should align to the business outcomes expected by the insurance company that removes NIGO errors. A fruitful partnership will balance customer and employee experience and help create sustained business value.

The proliferation of exponential technologies demands a constant rethinking of the competitiveness of each value chain component.

Removing NIGO issues would have a cascading effect on key business capabilities for insurance carriers. Insurers must realize that averaging the cost of transactions across capabilities is no longer a competitive play. Insurers must consider minimizing NIGO forms as the key to better customer experience, operational efficiency, and future-proofing the workforce.

Industry :

Tushar Sharma

Practice Lead (Solutions and Consulting), Life & Annuity, iCORE, DOP, Wipro

Tushar has been working in the Life Insurance industry across geographies for over 18 years. He has worked in advisory and delivery roles to drive operational and digital transformation and contact center/service center transformation strategy.

Before joining Wipro, Tushar worked with MetLife, IBM, ICICI Prudential Life, and Capgemini.

Kanika Anand

Manager, Life & Annuity, iCORE, DOP, Wipro

Kanika has over ten years of experience in the Insurance Domain. She analyzes business problems and presents automated solutions/recommendations for complete business processes in her current role. She has previously worked as a Product Owner and a Project Manager on New Business and Policy Admin systems.