As the world gets increasingly digital and connected, business value-chains are becoming more data driven. The intersection of data revolution and evolving customer preferences create a sizeable opportunity for Financial Services (FS) firms and will also drive the next phase of growth. It is imperative for FS firms to establish a stronger emotional connect with their customers, not just to create a good first impression but for a lasting relationship. The focus must shift from KYC (know your customer) to UYC (understand your customer). Thanks to the data revolution and new age technologies like AI/ML and advance analytics, it is now possible for companies to understand what their customers truly want, when they want and provide services to their liking.

A superior customer engagement is not just about creating a cutting-edge online and mobile platform however, it is shaped by consistently delivering an impeccable customer experience across every customer interaction. The experience should be seamless, especially on journeys that are more likely to take place over multiple channels, such as new account opening, financial advice, or issue resolution. Thus, having a single view of customer is a key requirement and critical to deliver real-time personalization, which we call as ‘hyper-personalization’.

What is Hyper-personalization?

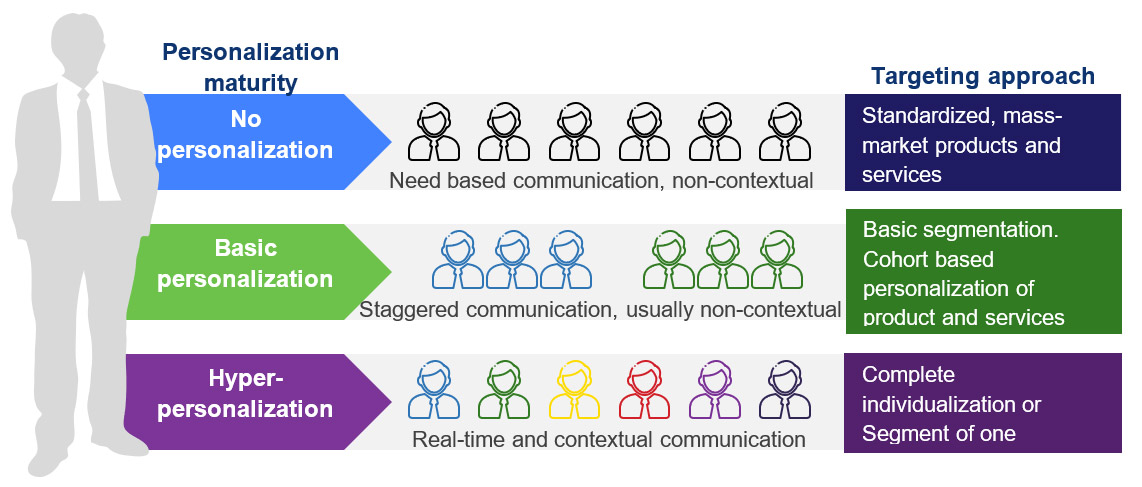

Hyper-personalization is an advanced and real-time personalization. Armed with contextual data, it leverages advanced analytics and AI with new approaches to segmentation and real-time interaction to deliver complete individualization. For eg. a bank offering a car loan to its client who recently took a test drive or an insurer offering pay-as-you-drive auto insurance policy with dynamic pricing.

Fig 1: representation of hyper-personalization

Meanwhile, hyper-personalization is not just big-data, it moves beyond ‘data-driven’ to ‘analytics-driven’ with a focus to better understand customers emotional state and the context behind it and responding/nudging suitably. The ability to leverage emotionally intelligent nudges in real-time will be one of the biggest, most important opportunities for FS firms going forward.

Hyper-personalization as a competitive edge

As FS industry become increasingly commoditized with margins coming under significant pressure, it becomes imperative for FS firm to better understand their customers. Understanding not only transactions but also financial needs, goals, and behaviors creates financial solutions that are both relevant and timely. This knowledge (data) also enables superior engagement across channels and forms the bedrock for hyper-personalization at scale.

If done properly, hyper-personalization enables FS firms in elevating customer loyalty and engagement. The existing customer base also act as an engine of advocacy to potential buyers.

Overall, hyper-personalization increases the potential to realize market leading revenue growth, while remaining nimble and cost efficient. FS firms that create and implement hyper-personalization strategies will be able to keep up with the increasing demands of consumers while staying ahead of their competition.

Future view: FS as a platform

The ongoing trend towards Platformization of Financial Services and subsequent change in business models like 'banking-as-a-platform' are creating exciting new ways to grow revenue streams, attract new customers and transition to adjacent industries. As the financial product is becoming less important than customer, BFSI firms are embedding payments, loans, insurance and wealth directly into the customer experiences.

Fig 2: Customer contexts around various financial products

Banking: For many banks, the vision is to move beyond banking to cater to overall financial wellbeing model, and bringing the marketplace of customized financial products across banking, wealth, insurance, utilities, etc. on a unified platform with a single-view for customers.

Capital markets: Some asset managers (AM) have already rolled out hyper-personalized offerings for their high net worth clients, powered by advanced analytics, machine learning, behavioral sciences, and sentiment analysis. These include, among other things, bespoke risk profiles, personalized portfolio construction and tailored nudges. AMs are now advancing towards offering hyper-personalization to retail customers as well, through rapid deployments of AI backed robo-advisors.

Insurance: Insurers have been one of the most prolific adopters of connected devices, leveraging it to launch shared-value insurance products and ‘pay as you live’ kind of offerings with dynamic pricing. Many large insurers have initiated or are part of cross-sector wellness ecosystems, where they gain multitude of insights into a customer, and are able to provide custom covers across their spectrum of risks.

Overall, the industry is moving to different value propositions: from ‘product based’ to ‘subscription based’ and ‘wellness ecosystems’; and from ‘static assessment and offers’ to ‘real time prescriptive analytics and nudges’ aka hyper-personalization.

Find out more in Wipro’s new report on hyper-personalization, in which we examine the changing landscape of customer engagement in the financial services space, along with imperatives for incumbents.

Harpreet Arora

Global Head of BFSI and Manufacturing Consulting Services

Harpreet is the Global Head of BFSI and Manufacturing Consulting Services at Wipro. As a part of the leadership team, Harpreet has global responsibility for overall strategy, consulting, research & insights and M&A, supporting Wipro's global suite of BFSI and Manufacturing clients in their transformation agenda. He brings strong credentials in providing strategic, innovative and transformational solutions to a number of large, complex relationships, and has been instrumental in leading some of the big-ticket deals in the industry over his career.

Supported by:

Tarun Kumar (Senior Manager – Wipro Insights)

Shiddhant Bhattacharya (Analyst – Wipro Insights)