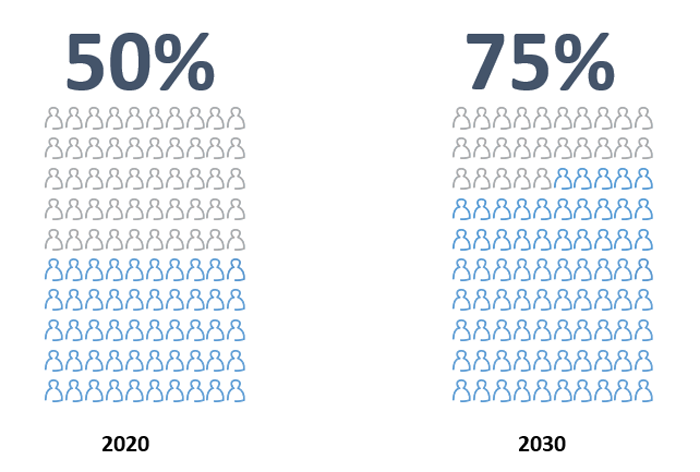

Globally, the financial-services industry is undergoing a significant transformation, driven by ongoing changes in the global economic, regulatory, and political spheres – and by one major shift in demographics: Millennials and Gen Z already make up half of the global workforce, and by 2030, they’ll represent 75%.

Figure 1: Increasing share of Millennials and Generation Z in workforce

Source: ILO workforce statistics, Wipro Insights

Growing economic clout

As more Millennials and Gen Z enter the workforce, their impact on the global economy will only increase. According to World Data Lab, millennials’ aggregate annual income is expected to surpass $4 trillion by 20301. Moreover, in the US, millennials are expected to hold five times as much wealth as they had in 2019, and the group is anticipated to inherit more than $68 trillion from its Baby Boomer parents by the year 20302.

The “Digital Native” generation

Millennials and Gen Z have never known a world without digital access to everything. This generation has already started to make a lot of routine financial decisions as well as plan for long-term financial goals and needs. Meanwhile, buying preferences of millennials and Gen Z customers are very much in sync with their digital-first attitude. They expect more personalized services based on their demographics, interests, location, and personality, and they want this level of personalization across all interactions.

Which means that, for financial-services firms, connecting digitally with Digital Natives is mere table stakes. But to win, financial institutions should build a new model of customer engagement that will deliver tremendous competitive advantage – and drive the next phase of growth in the financial-services sector.

Customer engagement reimagined – not just refurbished

Tapping this expanding opportunity requires a digital-first mindset. Most financial institutions need to reimagine their overall value proposition from the ground up, not just retool it. Old-school incremental legacy transformations will not help. To match the preferences of consumers and serve them in ways they like, financial-services firms must create seamless digital experiences in every interaction they have with each customer.

Most financial services offerings today are commoditized, and switching costs are low. Accordingly, the financial institutions that provide better customer experiences will become preferred providers. This is not optional anymore and will make or break market shares. A well-defined customer engagement strategy is necessary for firms that want to anticipate and meet the increasing demands of consumers while staying ahead of their competition.

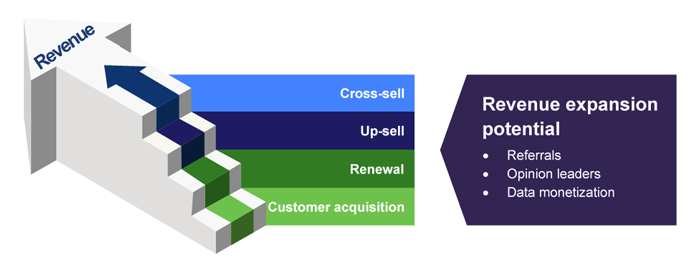

Figure 2: Deep customer engagement drives customer lifetime value

The tools to create superior customer engagement are here

The data revolution, coupled with cutting-edge technologies like AI/ML, has enabled organizations to truly connect with their customers and establish ongoing, value-driven, and emotionally resonant relationships. Recognizing the context behind the customer interaction is critical, enabling firms to respond in an empathetic and relevant manner. It also fosters more trusted and more convenient interactions, empowering financial institutions to drive customer engagement and growth in an increasingly digital world.

Many institutions have already begun investing heavily in technologies like artificial intelligence, machine learning, and data analytics while pursuing their digital transformation journey. For instance, banks and insurance companies are expected to increase their AI investments by 85% by 2025, according to the Economist Intelligence Unit. Yet many firms have been unable to reap benefits proportionate to their investments and have been unable to provide customers the personalized experiences they want.

So, the question remains: How can financial institutions best utilize the massive amounts of data and the advanced technologies at their disposal to create value for their customers?

Strive to create mutually beneficial value propositions

There has been exhaustive research on concepts like gamification and behavioral economics and how they can be applied to create mutually beneficial value propositions for customers and for the enterprise. Some financial institutions have successfully delivered on these concepts by building a strong understanding of their customers’ behaviors through real-time data and advanced analytics. Equipped with these insights, they gain the ability to deliver highly contextual messages to their customers – at the right place and time, and on the right platform – to nudge them toward favorable outcomes, like improved financial wellness.

In exchange for highly personalized, highly valued experiences, customers are willing to share more personal data with their trusted partners. However, they expect to be rewarded for sharing their data, and receive similar levels of personalization, or greater ones, than what is delivered by digital-first players like Amazon and Netflix. The time is ripe for financial industry players to ask: How can we effectively nudge customers to achieve mutually beneficial behaviors?

The future of customer engagement in the financial services sector

The concept of customer engagement within banking and financial services has already evolved from providing traditional persona-based offerings to more contextually personalized products and experiences, with a vision to achieve differentiation. New marketplaces and models (such as “pay as you live”, open banking) are seeking to redefine customer experiences and are gaining popularity.

Which model will emerge as the new standard for customer engagement across the BFSI? Will there be only one?

Find out more in Wipro’s new report on hyper-personalization, in which we examine the changing landscape of customer engagement in the financial services space, along with imperatives for incumbents.

References

Angan Guha

Chief Executive Officer - Americas & Executive Board Member

Angan is the Chief Executive Officer - Americas & Executive Board Member at Wipro. He drives overall business strategy and manages customer relationships across a range of sectors in North America including Financial Services, Manufacturing, Energy and Utilities, and High-Tech. Angan started his career with Wipro 28 years ago and has held various leadership positions across India, the UK, and the US. He has extensive experience in leading large transformational engagements and building high-performing global teams committed to client’s success. Angan is also a member of Wipro’s Group Executive Council.

Supported by:

Tarun Kumar (Senior Manager – Wipro Insights)

Dishank Jain (Assistant Manager – Wipro Insights)