June | 2021

Superannuation is a primary social security tool for Australians. As a compulsory retirement savings instruments for Australian citizens, superannuation funds play an important role for citizens as well as Australian economy. Amidst the COVID-19 pandemic, for example, the Australian government allowed people suffering from financial hardships to make early withdraws from superannuation funds.

Over last 12 months, the federal government has been focusing on improving superfund operations for better retirement for members. Your Future Your Super reforms, announced in September 2020, is focused on increasing transparency in operations so members can better track and manage their performance. In May 2021, the federal government announced measures to increase super inflows by way of higher contributions and new member addition:

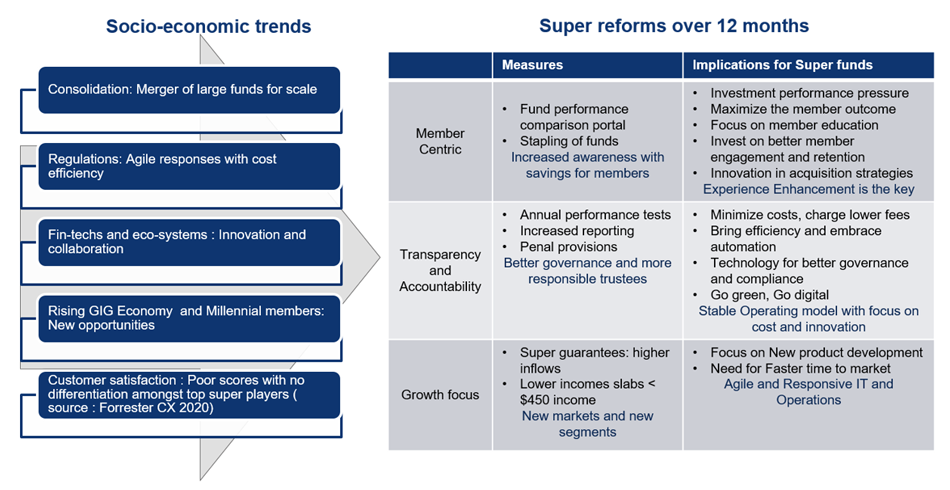

While above reforms are being implemented, superfunds continue to face dynamic macro-environmental factors, as shown in the Figure 1 below. The superannuation industry is undergoing a major consolidation due to five large mergers, with several more on the horizon. Other trends that superfund are watching closing include changing customer expectations, the gig economy and renewed interest in contract work, and rising FinTech interventions.

In such a situation, scaling up for a better member outcome is an uphill task with looming challenges around profitability, regulatory changes, customer retention and acquisitions of customers. It is apparent that superfunds will need to re-examine their member acquisition and retention strategies while focusing on costs and operational efficiencies at a scale.

Figure 1: Summary of reforms and their implications.

Over last eighteen months, large industry and retail funds lost significant assets, affecting their fee income dramatically in the context of early-exit schemes. New contributions from millennials members and gig workers are therefore very important. However, these members tend to have different priorities and significantly different service needs than those in regular salaried jobs. Further, they expect the best of digital experiences offered by FinTechs and investment start-ups.

Unfortunately, many established funds are working with inflexible administration platforms, archaic technology architecture, and outdated approaches. To keep pace with changes, these funds are updating everything from operations to infrastructure to customer relations. They are shifting focus from employers to members. They’re also replacing their rigid operating models with agile ones, with focus on automation, efficiency, and design-led experiences, which will help them build resiliency and better address the changing needs of new and existing members.

Emerging technology: Empowering advanced operating models

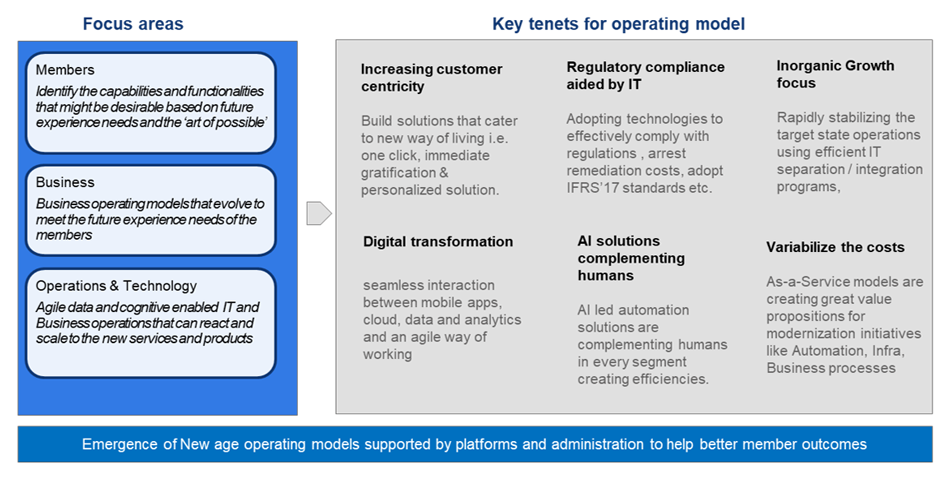

Regulatory reforms offer a great opportunity for superfunds to review their strategic priorities and create a more efficient, experience-driven, profitable fund. Adopting human-centric experience as a strategic priority can catalyze the above transformation, and tech-driven operational models can elevate user experience while streamlining processes. Strategic changes like these can help develop powerful capabilities that make it easier to respond and adapt to change.

Figure 2: Emerging operating models.

The following are some impactful first steps funds can take to build resiliency while reconfiguring operations

As the superannuation industry continues to evolve, funds can keep pace by focusing on developing stronger, more intuitive digital operations. The points outlined in this document show how strategic digital transformation can empower member and employees simultaneously, driving productivity, cutting costs, and increasing organizational resiliency.

Amol Pramod Ubale

ANZ BFSI Domain and Digital Leader

Amol Pramod Ubale leads digital insurance initiatives for Wipro’s BFSI sector in the ANZ region. He has 18 years of experience building digital insurance channels for group and employee benefits, pensions, and retail. Amol is currently focusing on building digital business solutions and platforms to transform the superannuation industry.