AI-led finance transformation brings efficiency, simplification, and drives valued outcomes

Mired in the day-to-day challenge of automating manual processes, many CFOs focus on short-term goals and have little time to develop long-term strategies to leverage AI for business outcomes and value delivery.

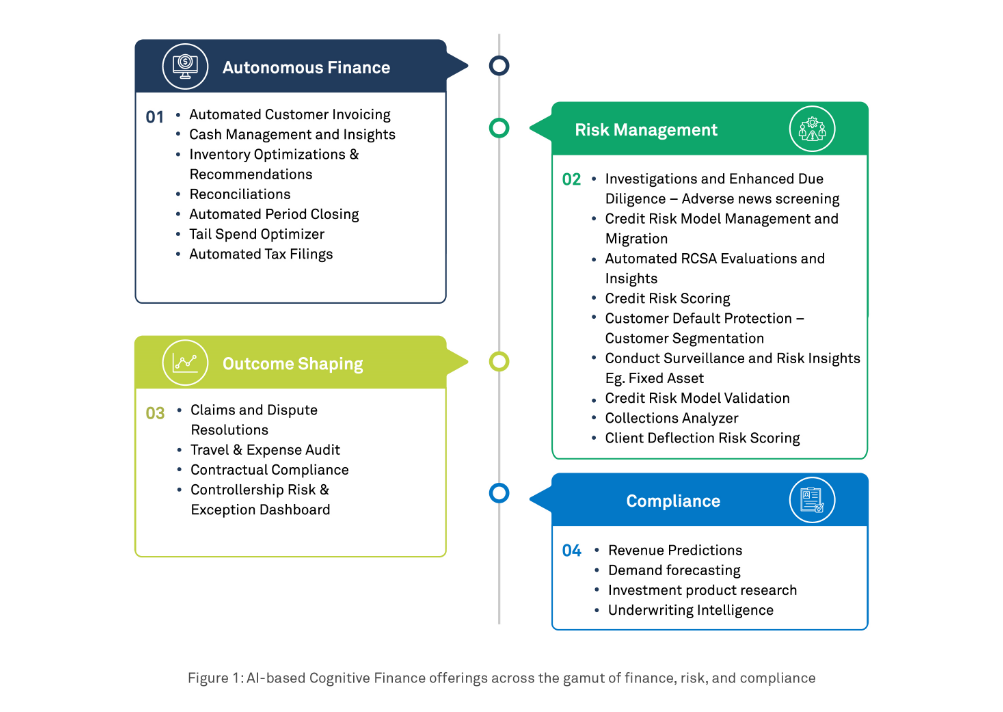

Wipro’s Cognitive Finance solution infuses AI into the finance value stream to optimize business operations, drive intelligent business enablement, and strengthen control and compliance. This infusion allows CFOs to operationalize intelligence and, ultimately, enable their finance transformation efficiently and simply.

Empowering businesses to manage finance and accounting operations for improved productivity, faster turnaround times and cost savings, Cognitive Finance presents better information access and customer interaction through a comprehensive portfolio of cognitive-led intelligent financial services.

Working across the finance and accounting value chain, Cognitive Finance’s range of solutions allows enterprises to gain a competitive edge through:

The additional AI-based offerings increase operational efficiency through automation and further finance transformation by allowing companies to build and implement innovative use cases for customers and create new revenue streams. To identify and discover AI use cases in a CFO organization, Wipro follows a unique methodology called Enterprise Intelligent Quotient framework (E-IQ) which uses the five pillars of Sense, Decide, Act, Interact and Adapt, that benchmarks your current E-IQ from a scale of 0 to 10 and provides a roadmap to attain an optimal E-IQ score for your finance organization.

Cognitive Finance helps enterprises build intelligent financial services by turning data into information, and information into insights, with AI-driven intelligence infused across multiple financial processes. To learn more about how Cognitive Finance can deliver on real-time insights and on-the-spot future forecasts, contact our team.