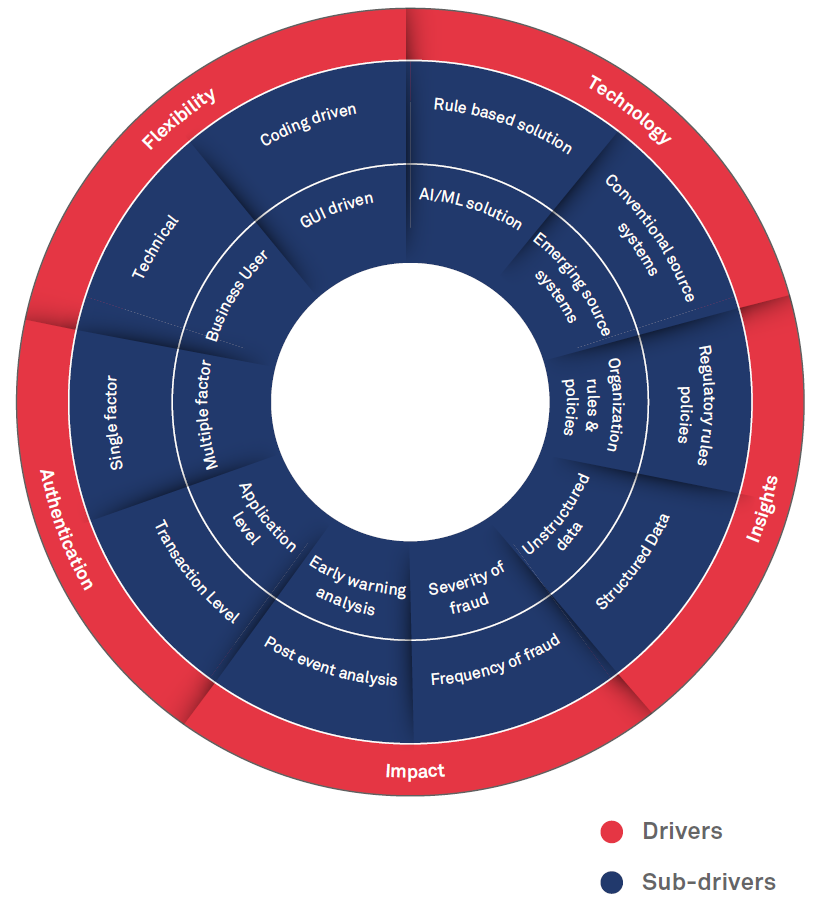

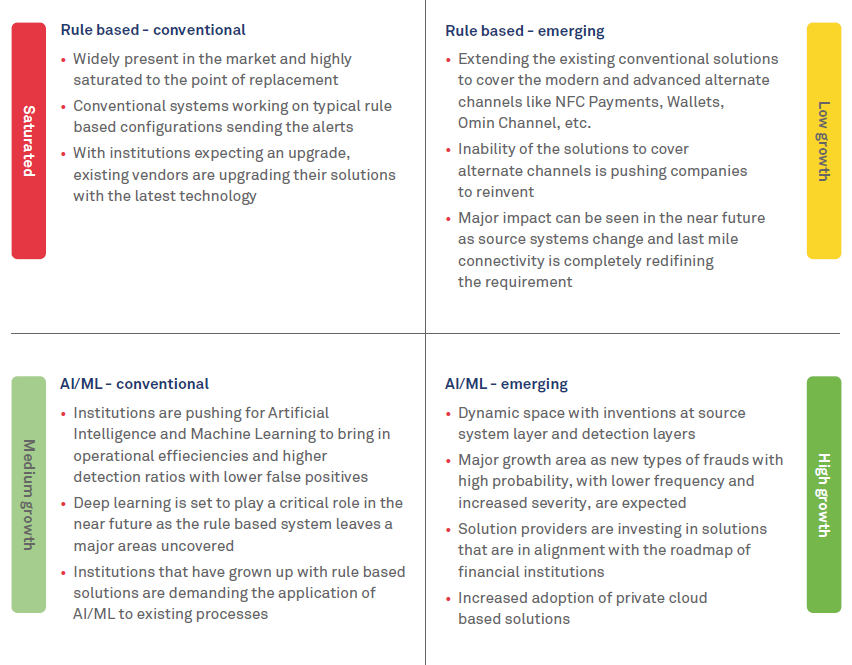

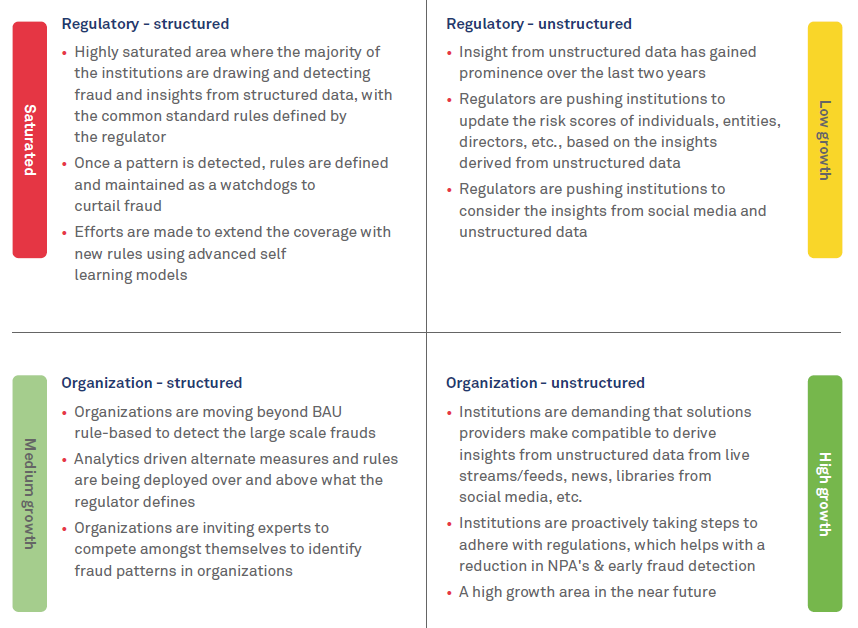

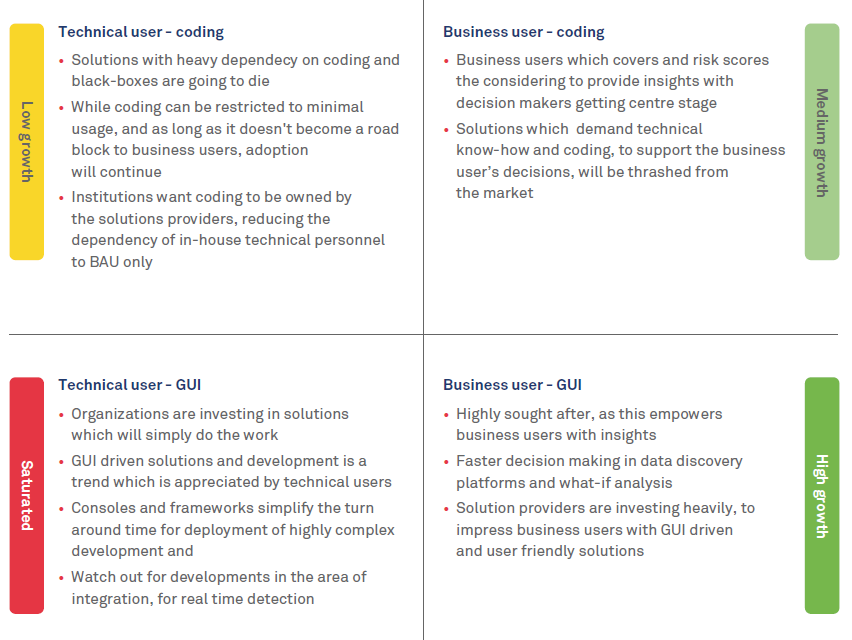

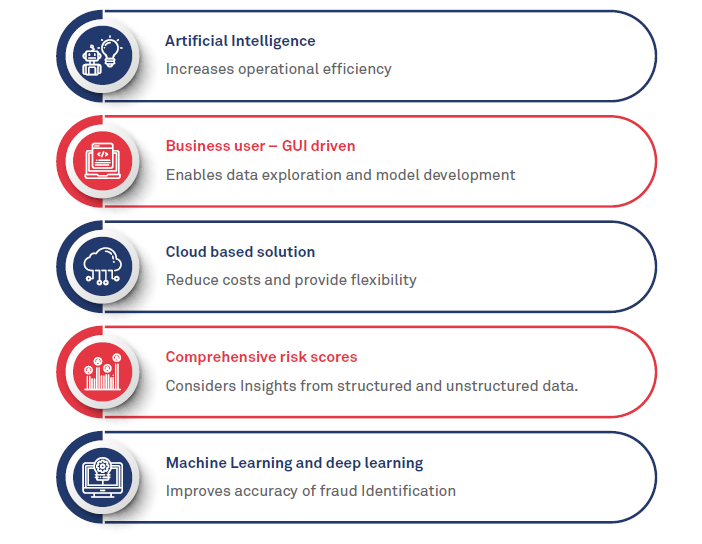

The regulatory compliance of financial institutions is growing at a faster pace than before. Moreover, technology firms are reciprocating with solutions at an even higher pace. Of late, emerging technologies like artificial intelligence and machine learning have seen practical applications, which were earlier restricted to theory. Multiple specialized and boutique firms are now offering domain specific solutions and use cases against the big players who use artificial intelligence and machine learning as a platform.

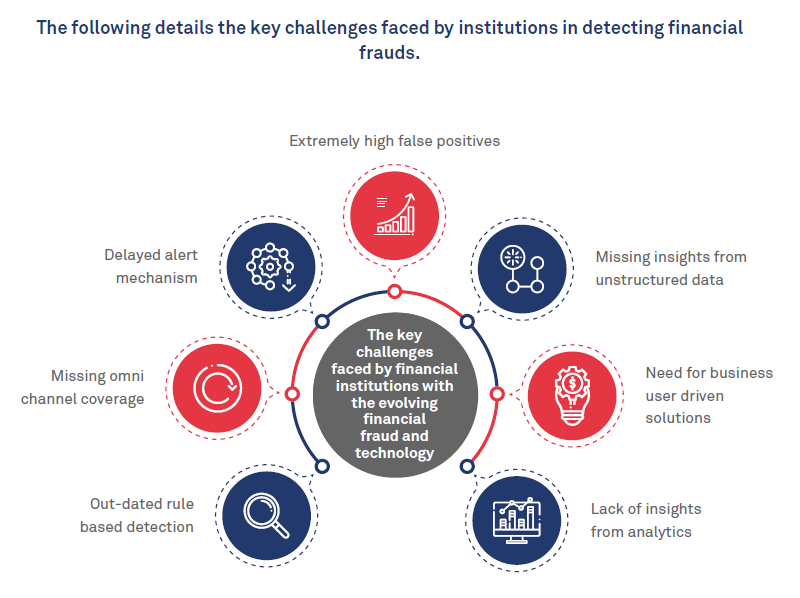

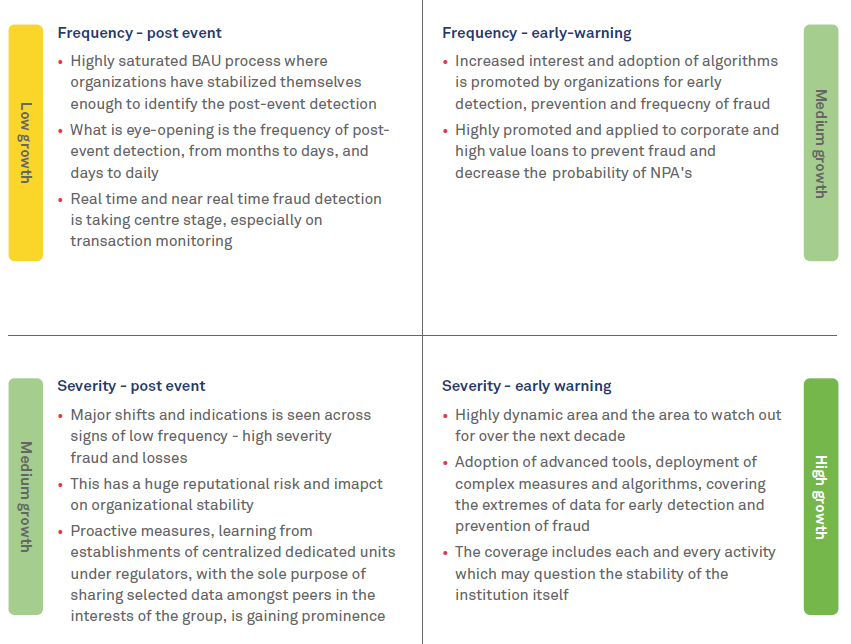

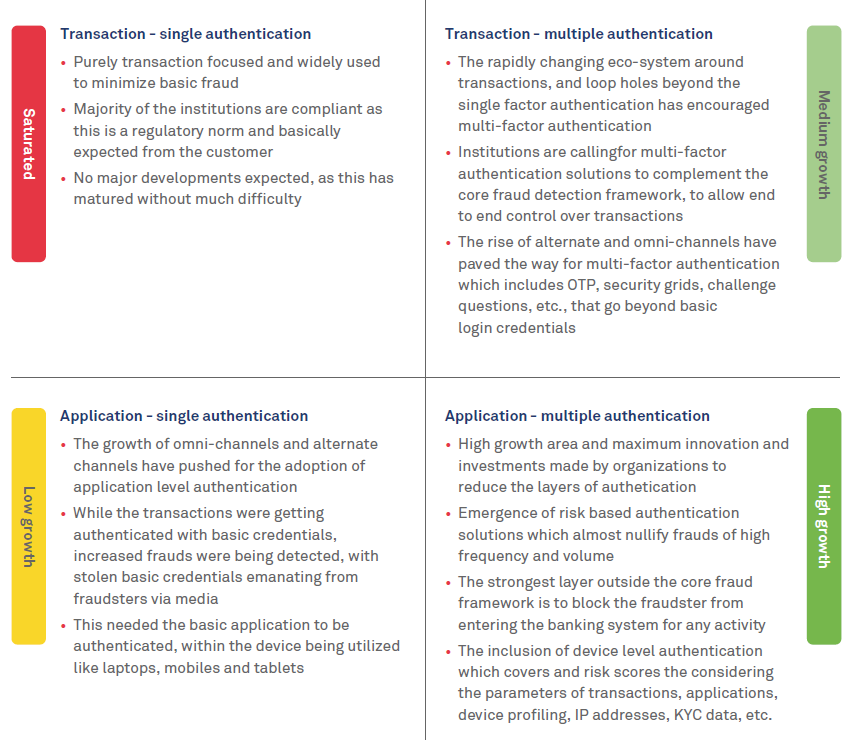

Institutions facing losses from financial crimes are growing at a similar pace. Fraudsters keep innovating and beating the system. This calls for a solution where technological advancements have to be leveraged to beat the fraudster and allow early identification of their modus operandi.

The next decade will experience a transformational shift in the areas of fraud detection and prevention as institutions look out for solutions which provide transformational benefits and ROI.

Benefits and ROI

Getting applied to

Financial crime detection and prevention is critical in any organization. Augmenting it with Artificial Intelligence and Machine Learning goes to show how far the industry has come in both theory and implementation.

Sharad Kumar Ragam - Practice Manager for Financial Risk & Compliance Wipro Ltd.

He has 11+ years of implementation, consulting and solutions experience, addressing the banking customers’ needs across Fraud Risk Management, Basel & Regulatory Guidelines and Integrated Risk Management.